Body of IITR

The Third-year, first semester marks the beginning of the internship season at IITR. Most of us have very little actual work exposure till that time and are hence unsure about what kind of work we would eventually like to do. I, too, was unsure about the exact kind of work I wanted to do after graduating, but I had narrowed it down to 2 major fields - FMCG product management (as a chemical engineering major, this would require both my core knowledge as well as managerial skills), and finance (an interest I had developed in my second year). After unsuccessful interviews and applications with the 2 major FMCG companies that came to our campus, RB and ITC, I decided to completely devote my time to improving my finance knowledge and eventually applying for a trading related internship in well known firms off-campus.

Applying to companies off-campus is not an exact science. I, personally, just used LinkedIn. The major steps I’d recommend following are:

1. Shortlist companies that have divisions whose work pertains to the profile you are interested in. For me, it was quantitative finance/ algorithmic trading. (at least 15-20 companies)

2. Find HR employees working in THAT DIVISION (Important, since HRs probably receive a lot of requests daily, and most of them won’t bother forwarding your resume to the respective division.)

or

Find alumni that are currently working in that company. BE SPECIFIC, so that they know exactly who within the company will be able to help you the best. Usually, they forward your request to the exact team. It’s even better if you find an alum in your specific division of interest.

3. After steps 1 & 2, keep taking weekly/ fortnightly follow-ups, and wait until someone from the respective team contacts you for an interview. Or a rejection.

**Divisions/ hierarchies become important only in large, well established companies that work in many diverse businesses. One can probably ignore those for smaller-scale companies and startups.

**Making an excel sheet to keep track of the above helps.

In my specific profile, the things which I knew, which eventually helped me in my interview are:

I started applying towards the end of January, and ended up receiving internship offers from Reliance Securities and Edelweiss by the month of May. Since Edelweiss has one of India’s most sophisticated trading desks, I chose to go with the latter.

Edelweiss’ trading desk is located in its head office in Kalina, Mumbai.

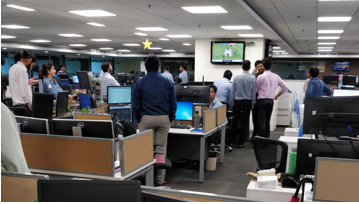

The trading floor consists of a number of teams, each carrying out a different type of trading, such as Quant trading, High Frequency trading, Vega trading, etc, along with a Risk team and a HR team. Each team is headed by a few experienced traders and operates independently. Different teams may operate in different market segments, and they formulate strategies specific to their frequency of trading and areas of operation. The floor as numerous TVs continuously running news from different channels. Multiple Bloomberg terminals are placed at convenient spots. The floor has no cubicles, only desks and separate areas for different teams.

Most of the day’s work happens during trading hours, i.e. 9 AM- 4PM. Individual traders and teams monitor their existing strategies and beta test new strategies. They keep a close eye on the news as well, which helps them gauge the existing market scenario so that they employ the most profitable strategies for that particular day. Everyone is extremely busy during these hours and the office remains silent during this time. After the market closes, the work for the day is mostly done, unless the team is brainstorming or researching a new strategy. A majority of the office leaves by around 5:30 - 6:00 PM.

I worked in the High Frequency Trading (HFT) division. Over the course of my internship, I worked on 1 major project which involved constructing a profitable HFT strategy that operates using market microstructures. This was divided into 3 major stages: 1. Creation of various tools for analysing the profitability and sustainability of any trading strategy using a variety of metrics and charts. 2. Ideating a strategy by reading through different financial literature and taking inspiration from good research papers. 3. Constructing the final strategy and tuning it to perform reliably in different market scenarios, as well as deciding a basket of similar stocks on which this strategy performs well.

I ended up creating an algorithm that trades in seconds across a number of stocks and takes advantage of volatile price movements.

Edelweiss does not believe in spoon-feeding. Help and support is offered to those who remain proactive. You will be expected to take ownership for both the good and bad work that you have done. Everyone is easily accessible, even the head of the trading division. I had personally met him twice during the course of my internship. A lot of the traders are IIT+IIM grads and are highly experienced, and won’t hesitate in giving you a lot of ‘gyaan’ on a variety of subjects. :p

Overall, my experience at Edelweiss gave me enough knowledge to make a well-educated decision about what I would like to do after my graduation and helped in cementing my desired career trajectory, at least for the foreseeable future.